Canada’s national downtown office vacancy rate reached a record high of 19.4% to end 2023, according to data from commercial real estate and investment firm CBRE. A “healthy” office vacancy rate would fall between 10% and 12%.

The COVID-19-induced work-from-home shift has had a major impact on the office market, with Maria Benavente, vice-president and real estate-focused portfolio manager at Dynamic Funds, claiming 10% to 15% of demand has been “permanently destroyed.”

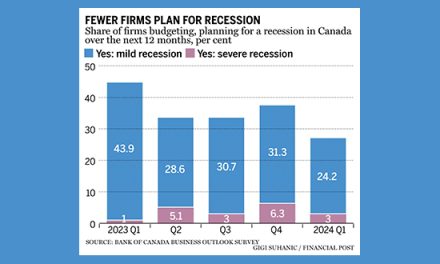

However, Marc Meehan, managing director of research for CBRE Canada, says remote work is not the largest contributor to the third-quarter downtown office vacancy rate. New supply is the biggest factor, followed by fears around a recession or concerns around a potential recession and what growth might look like.

Another factor, according to Meehan, has to do with the tech sector. During the pandemic, there was a lot of demand from U.S.-based tech companies in Toronto, Vancouver, Waterloo, Ottawa, Montreal, and Calgary.

Canada has high-skilled tech workers coming out of Canadian universities and can also bring in skilled workers through accommodated immigration programs that have accelerated entries. However, tech valuations began dropping, largely halting hiring and expanding operations.

If you take Toronto out of the equation, net absorption, which measures the demand for office space, is largely improving in most of Canada. Calgary, for example, has seen a significant rebound in its downtown vacancy rate, with a positive net absorption of 667 square feet throughout 2023. Calgary also has a successful office conversion program, offering incentives to transform less functional office buildings into residential units.

Outside of Calgary, CBRE saw improvements in Vancouver, Edmonton, Ottawa, and Halifax, but massive new supply in other cities remains.

Source: Global News